The final couple of days are miserable for some associated with the largest malls in america. On Nov. 11, Macy’s reported quarterly revenue that performedn’t meet expectations, and its own stock took a nosedive. Nordstrom adopted the afternoon after, reporting a dismal 42per cent drop in earnings, and suffered an equivalent battering in the market. JC Penney, that will be attempting for a turnaround after many years of struggling, actually did a lot better than anticipated, but nonetheless maybe not great—and shares tumbled.

The final couple of days are miserable for some associated with the largest malls in america. On Nov. 11, Macy’s reported quarterly revenue that performedn’t meet expectations, and its own stock took a nosedive. Nordstrom adopted the afternoon after, reporting a dismal 42per cent drop in earnings, and suffered an equivalent battering in the market. JC Penney, that will be attempting for a turnaround after many years of struggling, actually did a lot better than anticipated, but nonetheless maybe not great—and shares tumbled.

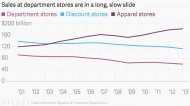

Every quarter provides a chance for malls to please investors, however the long-term trend is consistent: shops are slowly withering, due to the fact net also clothing merchants suck the life span regarding all of them.

Total emporium product sales dropped 35% between 2001 and 2013, based on information from American Apparel & Footwear Association. That quantity includes product sales of most products, not just apparel, a crucial group for Macy’s, Nordstrom, and JC Penney.

In the same duration, sales at attire stores—think every clothing merchant in your local shopping mall that'sn’t a department store—grew 52per cent. Those include ultra-cheap fast-fashion stores particularly H&M and Zara, which can be likely the main cause for the sliding sales at rebate stores, including as TJ Maxx and Marshalls.

In the same duration, sales at attire stores—think every clothing merchant in your local shopping mall that'sn’t a department store—grew 52per cent. Those include ultra-cheap fast-fashion stores particularly H&M and Zara, which can be likely the main cause for the sliding sales at rebate stores, including as TJ Maxx and Marshalls.

The development of cheap, fashionable fast-fashion was unstoppable in america previously decade. To illustrate the idea, Macy’s popular New york leading store on 34th Street today shares the corridor with three H&M stores, such as the world’s largest, that will be literally across the street from of the various other areas.

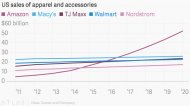

Online stores have now been getting consumers from shops, too, and lowering base traffic to their brick-and-mortar stores. Financial firm Cowen and business predicts department-store clothing product sales will develop a little within the following many years, but Amazon will blow past all of them to surpass Macy’s because the biggest clothes retailer in the usa by 2017.